Have you ever heard of blockchain encryption?

|

| Centralised DB v Blockchain DB |

No? Well no doubt you are not alone in that regard, but increasingly its becoming part of the modern world.

It was invented by a person, or possibly a group of people using the nom de plume Satoshi Nakamoto (claimed to be a man called Craig Wright, but disputed by a business partner Dave Kleiman, and subject to a court battle - update now resolved) in 2008, in order to secure the data of, and to serve as the public transaction ledger of the crypto-currency Bitcoin, which you will have probably heard of, but like me not been totally sure how it works.

Like all currencies, Bitcoins exists via trust ... for example a pound sterling is accepted worldwide because everyone accepts that its a currency, similarly the Yen, the US Dollar etc etc. Some other countries have currencies that are not accepted by anyone, including their own citizens e.g Zimbabwe, which used the South African Rand as currency, when its own people refused to use the Zimbabwe dollar in April 2009.

Of course trust can make almost anything a currency, so for instance seashells (in some Pacific islands before Europeans arrived), or gambling tokens (backed by a casino, who will exchange them for another currency), or even postage stamps, can all be treated as money, as long as both parties accept that they have some intrinsic value which is exchangeable. The principal is the same whatever is accepted.

|

| A Bitcoin .... |

So a bit of

background. Bitcoins are an electronic currency that has no physical

form i.e. no notes or metal coins, but which is held in a secure electronic wallet

by the owners. They are created via a process called Bitcoin mining which is explained on this site.

You purchase them by going to a Bitcoin exchange, setting up an account and adding a bank account, debit card, or credit card, in order to make your first Bitcoin purchase at the exchange. You can even do it using Paypal for extra security.

But it, like any crypto-currency, can only work if :

(a) It is trusted as having an exchangeable value in a physical currency, or can be used to make a purchase of goods and services electronically e.g. via your visa debit card.

(b) It is safe and secure from fraud or manipulation, and

(c) It can be converted into other currencies. In order to achieve this last condition there are Bitcoin exchanges where you can buy or convert Bitcoins.

But as with any currency, there could still be fears that someone could manipulate the supply of the Bitcoins (e.g. to raise or lower their value), and also that database ledger entry forgery could be far too easy. So this is when blockchain encryption was developed in 2008 .

Essentially this is a database chain which is rather like a huge finance book or ledger - one that every Bitcoin owner has their own copy of, but which identical copies of which, are also held by every other owner of Bitcoins, in the form of a distributed ledger called a blockchain, that tracks all the transactions in that particular currency. These wallets are locked (encrypted) and personal password protected for each individual owner, and can be held on-line, or stored off-line on a hardware device similar to a USB drive.

So each crypto-currency such as Bitcoin, has now got:

- Security - Each transaction is secured with cryptography. Cryptography is the fundamental building block based on which blockchain has been developed.

- Location Choices - The crypto-money is usually held in either 'warm' or 'hot' digital wallets OR 'cold' wallets. 'Warm' or 'hot' digital wallets are usually based online and are designed to allow users to access their cryptocurrencies more easily, while 'cold' wallets are offline, and harder to access and therefore supposedly more secure.

- Transaction Shared - The database movements are shared between parties (peer-to-peer), without the need for any intermediary to verify the authenticity of the records of the database, thereby not needing a central authority to be trusted.

- Distributed - The blockchain database is distributed with multiple replicas of the same database. This also means that the trust in the data is also distributed. How is this achieved? Through a mechanism of consensus.

- The Shared Ledger - The ledger is where you can only write to and cannot alter records once written. The blockchain database can only be appended with immutable records of each transaction and time-stamped. The transactions are recorded in the shared ledger in a secure and verifiable way, reducing to virtually zero the chances of someone tampering with the records and not being spotted.

So every time a Bitcoin is sent from someone to another person, a record of that transaction goes into theirs and everyone else's copy of the ledger. So no one, not banks, nor governments, or the person who invents it, is in charge of the database or can change it.

All this apparently solves the fraud and supply issues and means that Bitcoins supposedly can't be faked, can't be hacked and can't be double-spent (you spend one, it moves in everyone's database/ledger). By using distributed ledgers on a decentralized network of computers, the network is able to monitor everything, ensuring the currency’s integrity and the ownership of all Bitcoins.

However there are increasing warnings that all is not as it should be, at least with the Crypto-currency world. The issues seem to have arisen because crypto-currency sales, security, and development is not regulated by the worlds financial authorities such as the Financial Conduct Authority (FCA) in the UK. But across the globe these authorities are now increasingly cracking down on the exchange operators e.g. Binance, the world's biggest crypto-currency exchange, has recently been banned by the UK's financial regulator from conducting any "regulated activity" in the UK. Whilst the FCA does not regulate crypto-currencies per se in the UK, it does require all exchanges to register with them, which Binance failed to do.

This general lack of official oversight of non regulated crypto financial activities, means that usually you only have the word of the exchange operators, that a proper Blockchain database has been set up. But if it hasn't, then all the supposed safeguards of he crypto-currency are gone. Additionally if your investment fails, then you lose all your money, with (in the UK), no recourse to the Financial Services Compensation Scheme, or the Financial Ombudsman Service.

Recently there have been some worrying signs that the crypto-cowboys have moved in .... South African Bitcoin investment firm Africrypt (founded in 2019 in a bedroom, by two Indian descent teenagers, Raees and Ameer Cajee), has been referred to the police, with allegations that £2.6bn ($3.6bn) has been stolen, "absconded" by the two brothers. They deny it, claiming the money disappeared as a result of a hack and theft, and some analysts also say that the amount that could have disappeared, and is therefore being claimed for, has been grossly exaggerated, and was more likely to be around $100m US.

Even so, the whole point of this technology is that its supposedly hack proof, and theft proof ... in fact totally secure. And perhaps it is, if set up correctly.

However where irregularities have been proved, in theory it could only be because no Blockchain database was actually set up in the first place. Because if one was set up correctly, then how did someone or some group "abscond" with the Africrypt funds? - the firm claimed that "Our system, client accounts, client wallets and nodes were all compromised," in the alleged 'hack.' ... But that shouldn't have been possible should it, in a decentralised ledger system?

|

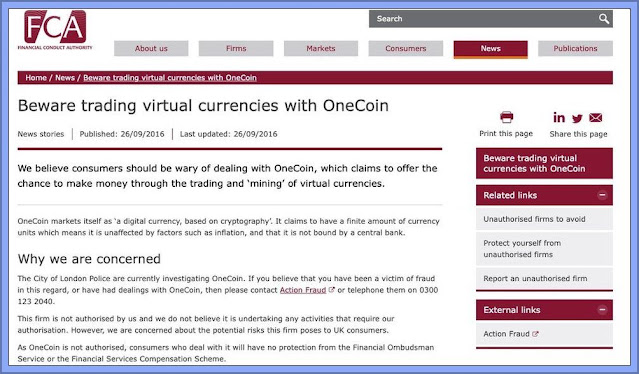

| The UK's FCA Warning Was Taken Down Because It Had 'Been Up Long Enough.' |

NB: Do not ever speculate, or purchase any Crypto-currency that doesn't have a full blockchain in place ... they are very possibly scams, and could be just a form of pyramid scheme e.g. search 'OneCoin' and FCA to see warnings that have been issued.

Now you might think so what? ... I missed out on the cheap Bitcoin

phenomena in 2009, and now they are expensive, and have lost all the

possible quick profits (and now are like speculating in any other currency), and not really very practicable down the shops etc. So what if a bunch of scammers are now moving in on the product and taking investors/speculators funds?

I might agree but the problem is that the Blockchain technology that supports the Bitcoins and other electronic currencies, is now being used in other ways. For instance in Hong Kong, free speech and pro-democracy campaigners, have backed up pro-democracy newspaper's such as Apple News, on-line articles on to censorship-proof blockchain platforms, as the CCP censor or close down the free press in the autonomous enclave. They can't stop the CCP tyranny but hope that by keeping old posts safe, better days may eventually come ... however, if these Blockchain systems are not totally secure, then they may be in for a rude surprise.

Its also being proposed to use blockchain platforms in the USA, for the purpose of monitoring and recording voting in elections, where absentee / postal votes are a possible source of voter registration fraud. This idea has arisen because of the allegations of such postal fraud in the last US Presidential Elections, and if adopted in the US, is likely to widely be adopted elsewhere as well .... but again if not that secure a foreign or domestic group could gain control of the voting.

If you consider that a vote is like a small piece of high-value data, then its no different from a highly valued Bitcoin. On-line voting is cheap (far cheaper than postal or manual voting e.g. in the US a single vote currently costs between $7.00 and $25.00. An on-line vote costs just $0.50 per vote), and also gives instant count results (no counters needed). As described above, the idea is that blockchain based voting application wouldn't need to concern itself with the security of its Internet connection, because any hacker with access to a terminal, will not be able to affect other ledger/nodes or so its claimed

So just like Bitcoin owners uniqueness, voters can effectively submit their one vote without revealing their identity or political preferences to the public. Officials can then count votes with absolute certainty, knowing that each voting token or ID can be attributed to just one voter, no illegal vote can be created, and that all tampering is impossible.

So, whilst this technology seems esoteric and of no impact to the vast majority of us, it very well may be the way our democracies are secured in the near future, as we increasingly move from physical voting, to electronic or postal votes. So if in fact hackers are able to break this technology and walk away with $Millions (or even $Billions), as Africrypt have claimed, then is it really secure enough technology for a democracies to run its elections on?

That's a question the answer to which, hinges on whether Blockchains have really been compromised or these reports of hacks and thefts are from systems that were not using this fairly new technology.

Hopefully the explanations and diagrams are clear enough to explain the technology, because its easy to get a bit confused when explaining this subject ..... I admit that I had to reread this post several times before committing it, just to be sure I hadn't twisted my explanation myself (it was a fairly new concept to me as well, and I worked in IT for over 20 years!).

For more on Data Mining read here. For Cryptocurrency's in general read here.

Update 11/08/2021:

Yet another crypto-currency hack theft reported, with exchanges such as Coincheck and Mt Gox and now Poly Network hacked. It appears to me that this technology is not as advertised, and if I had any crypto-currency I would turn it back in to a regular currency asap.

Update 20/08/2021:

And another ..... Japanese cryptocurrency exchange Liquid has been hacked, with almost $100m (£73m) estimated to have been stolen. This time the crypto money was taken from 'hot' wallets. Back in 2014, another Tokyo-based exchange MtGox collapsed, after almost half a billion dollars of bitcoin went missing.

Is blockchain technology all that secure after all?

Update 08/09/2021:

El Salvador adopted Bitcoin as legal tender with a few teething problems.

Update 14/01/2022:

Its been reported that North Korean state backed hackers (the so-called 'Lazarus Group'), controlled by North Korea's primary intelligence bureau, the Reconnaissance General Bureau, stole almost $400m (£291m) worth of digital bitcoin assets, in at least seven attacks on cryptocurrency platforms in 2022.

Update 31/03/2022:

Yet another cryptocurrency hacked .... after the Ronin Network has had $615m (£467m) stolen. The network allows players to exchange the digital coins they earn in the game Axie Infinity with other cryptocurrencies like Ethereum.

The five largest-ever cryptocurrency hacks based on the dollar value at time of hack:

- $325m - Wormhole, February 2022

- $470m - Mt Gox, February 2014.

- $532m - Coincheck, January 2018

- $540m - Ronin Bridge, March 2022.

- $611m - Poly Network, August 2021

Update 07/04/2022

The UK Treasury has announced that it will regulate some cryptocurrencies known as "stablecoins" which will become recognised forms of payments. "Stablecoins" are designed to have a stable value which is linked to traditional currencies or assets like gold. They are considered less volatile than cryptocurrencies such as Bitcoin. However there are plans to consult on regulating a much wider range of digital currencies later this year.

Update May / December 2022

In May 2022 the terraUSD and Luna tokens, so-called "Stablecoins" collapsed, with an initial estimated $40bn (£32.7bn) loss. Its founder Do Kwon was arrested, and was charged with fraud and breaches of capital markets law, but then fled the country. In December the South Korean authorities said that he was in Serbia and that they had asked Interpol to arrest him.

The so called "Stablecoins" went from a $116 high values in April, to a Terra coin being now worth less than $0.0002. Globally, investors in the two coins lost an estimated $42bn, according to blockchain analytics firm Elliptic.

On top of this, large crypto companies like Celsius, Three Arrows Capital and BlockFi have gone bankrupt, leaving investors both large and small, out of pocket, and police investigating what happened. While Bitcoins themselves have suffered a 70 per cent fall in value to $18,000.

Finally in November 2022, FTX went bankrupt. FTX was one of the world's biggest cryptocurrency exchanges and valued at $32bn (£26bn). There are suspicions that customer funds may be missing and US Authorities are investigating. It was run by Sam Bankman-Fried.

Update Novmber2023:

FTX founder and CEO Sam Bankman-Fried, who once ran one of the world's biggest cryptocurrency exchanges, has been found guilty of fraud and money laundering after being arrested last year after his firm, FTX, went bankrupt. FTX was once valued at $32bn (£26bn), but when it went bankrupt in November last year $8bn in customer funds was missing. He used some of the money to repay Alameda lenders, buy property and make investments and political donations.

Binance chief executive, Changpeng Zhao, has resigned after pleading guilty to money laundering violations. Binance (registered in the Cayman Islands), is the largest crypto-exchange in the world, and also has to pay $4.3bn (£3.4bn) in penalties and forfeitures.

The exchange was used to illegally move nearly $900 million in transactions between US and Iranian users, and millions of dollars in transactions between US users and users in Syria, and in the Russian occupied Ukrainian regions of Crimea, Donetsk and Luhansk, as well as $106 million in bitcoin to Binance.com wallets from Hydra. Hydra (a Russian darknet marketplace used by criminals).

Even the production of Bitcoins (known as mining), is a cause for concern as an ecological problem, as well as an unnecessary currency with doubtful security.

ReplyDeleteI freely admit that my understanding of how these Bitcoins are created, and why they even have any worth is a subject that I am weak on. So I'll take your (and the articles) word for it.

DeleteThanks for the comment on what is a rather specialist post.

The weakness of Cryptocurrencies is that although they rely on the blockchain and because each block is linked, it is theoretically impossible to change a block of code without altering the whole chain .... But the Server that hosts them, well that's another matter ... Hack the server and then you can steal the passwords. Then you move the bitcoins from one address to another and then people don't have access to those bitcoins and the hacker does.

ReplyDeleteYour right of course ... personally I see no great advantage to cryptocurrencies and quite a few risks. It has all the feel of a Ponzi scheme. But I'm probably just being a Luddite. Thanks for the comment and sorry I didn't respond earlier.

DeleteThe Crypto-currency market seems to be going through a crisis of confidence. They have all lost value recently and a few are collapsing.

ReplyDeletehttps://www.bbc.co.uk/news/technology-61425209

One Bitcoin is now worth about $27,000, its lowest value since December 2020 and down from a high of nearly $70,000 late last year.

None of the others are showing any better results. A lot of people have had their fingers burned this year ha ha.

Nothing has made me think its anything but a bubble waiting to burst. Thanks for the comment.

DeleteThe collapse of the imaginary money bank FTX shows just how fragile the whOle Bitcoin economy real is.

Deletehttps://www.bbc.co.uk/news/business-63601213

I repeat. Nothing has made me think its anything but a speculative bubble waiting to burst. Thanks for the comment Frank

DeleteAccording to reports, Binance is in trouble in the Netherlands and France. The US has also tightened regulations on the whole area of bitcoin's. The house of cards is crumbling.

ReplyDeleteI've never really seen the attraction of crypto-currency ... 'mined' by computers 'your having a larf' as they say. The amount of fraud in this sector, and the vast amounts involved, are a worrisome factor, in what's lets be honest, is effectively a gambling commodity exchange, like pork belly futures. Thanks for the comment.

Delete