When Charles the first of England, couldn't get the English Parliament to give him more money, via more taxes, to fund a foreign war .....

|

| Regime Changes After Taxes Can Be Violent |

..... he dissolved it after a one day. He then ruled without it for 11 years.

This was known the "eleven years' tyranny," because only a Parliament could legally raise taxes. So Charles's capacity to acquire funds for his treasury was limited to his customary rights and prerogatives ... which he took full advantage of. This was probably one of the the first times in modern times (but certainly not the last time), that taxes led to a Civil War / Revolution and regime change with Charles losing his throne (and his head).

It certainly wasn't first time in England .... In 1381, the Peasant's Revolt occurred in England, when Wat Tyler led an uprising over a new poll tax. He came within a sword stroke of toppling the crown. Later on the American Revolution chant of "No Taxation, Without Representation" was one of the key demands that lost Britain its North American colonies ... as they still like to remind us.

|

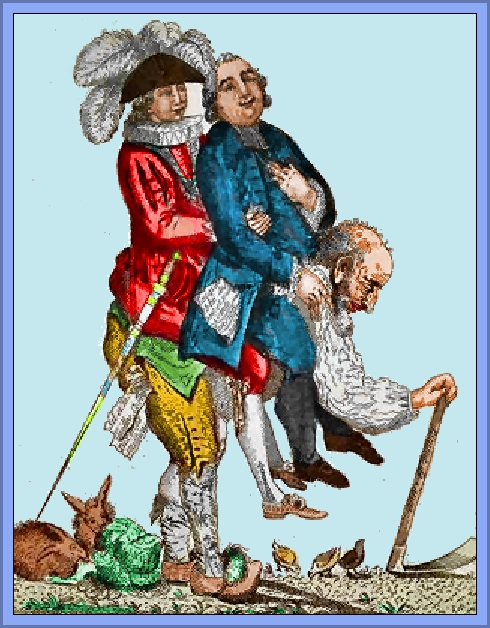

| Tax Burden Always Falls On The Third Estate |

French taxes emerged to fund the 100 Years War and subsequent conquests, with the peasants carrying the nation’s taxation burden. In fact the the Ancien Régime’s taxation regime was seen as excessive because of its expensive warmongering, and bloated because of its large bureaucracy, inefficient because it was collected by private tax farmers, and very unfair largely because the principal burden fell on the 'third estate'; (the commoners) .... in fact the taxation regime was a significant source of revolutionary grievances that led to the French King also losing his head and his regime.

While in Russia, its first revolution in 1905 when the Dumas took control of some aspects of government, included tax issues ... a brief dispatch from London sent on this date in 1905 included this excerpt: "...... The peasants in the Radoni district have refused to pay the taxes and have offered armed resistance to the tax gatherers."

Oddly, many of the taxes that caused the regimes problems, were those raised to fund wars, especially unpopular wars fought as vanity projects, by rulers or leaders who wanted to strut the international stage. As one later writer put it “The history of American taxes, can largely be written as a history of America’s wars.”

This may well be why it is, that so many modern regimes, that can live off the incomes of their natural resources such as oil and gas, are so prone to dictatorship, autocracies, and royal rule. States that can fund themselves through mineral wealth, don’t rely so heavily on their citizens for funds, and so are less vulnerable to the demands for democracy from those citizens.

So for example, Russia has had one of the lowest income tax rates in the world .... 40 per cent of its revenue has come purely from gas and oil exports. But can President Putin afford to raise its tax levels on the common people, in order to bring the public accounts in to shape, and pay for his war?

Its the same question that previous rulers have wrestled with over the millennia, and not always found the right answer. He isn't the first, and won't be the last to do so ...

No comments:

Post a Comment

All comments are welcomed, or even just thanks if you enjoyed the post. But please make any comment relevant to the post it appears under. Off topic comments will be blocked or removed.

Moderation is on for older posts to stop spamming and comments that are off topic or inappropriate from being posted .... comments are reviewed within 48 hours. I don't block normal comments that are on topic and not inappropriate. Vexatious comments that may cause upset to other commentators, or that are attempting to espouse a particular wider political view, are reviewed before acceptance. But a certain amount of debate around a post topic is accepted, as long as it remains generally on topic and is not an attempt to become sounding board for some other cause.

Final decision on all comments is held by the blog author and is final.

Comments are always monitored for bad or abusive language, and or illegal statements i.e. overtly racist or sexist content. Spam is not tolerated and is removed.

Commentaires ne sont surveillés que pour le mauvais ou abusif langue ou déclarations illégales ie contenu ouvertement raciste ou sexiste. Spam ne est pas toléré et est éliminé.