Do you remember a few years ago, when the UK government was forced by campaigners to crack down on payday lenders?

|

| Wonga Once The UK's Biggest Payday Lender |

The criticism was for the high-cost, short-term loans, seen as targeting the vulnerable, and that were advertised regularly on TV and other social/media platforms.

For example Guy Anker, deputy editor of MoneySavingExpert.com, said in 2018 that: "Payday loans are hideously expensive and morally questionable products - and many have been mis-sold to vulnerable customers. They should only be seen as a loan of absolute last resort. So to have one [Wonga] fewer payday loan lender - and Wonga was a biggie - is positive for consumers, but of course is very sad for the staff who will have lost their jobs."

While Mick McAteer, a former board member of the UK's financial watchdog, says that by improving the regulation of "subprime" lenders, they have protected people from being targeted with unaffordable loan products ..... so that crackdown was a victory then?

Well perhaps not. As you and most people, outside of those campaigners from the 'poverty welfare industry,' could have easily predicted, it didn't remove the need for these types of loans.

So, although it eventually put some 'legal' payday loan companies such as Wonga (then the UK's biggest payday lender) out of business, via a 2014 Financial Conduct Authority ruling that ordered it to pay £2.6m to compensate 45,000 customers, other lenders simply entered the market .... often illegally.

At the height of its success Wonga had a million customers in 2013, and was estimated to be valued at $1bn (£770m) in 2012 when it was considering a US stock market flotation ... but it went into administration before closure in 2018, rightly or wrongly, blaming the new regulatory regime for its demise.

|

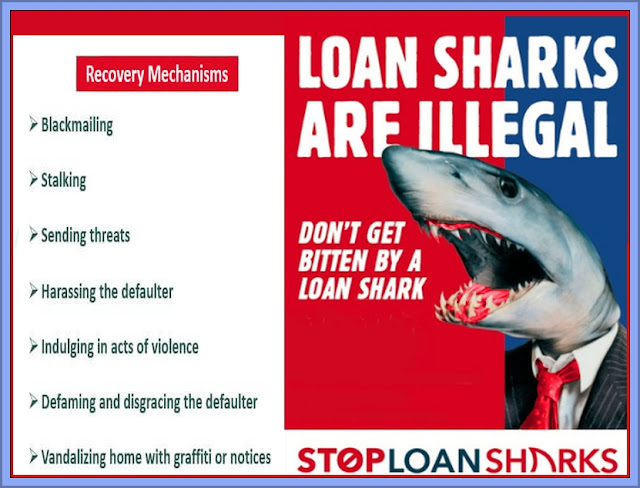

| Loan Sharks Are Illegal |

Yes, the illegal money lenders, aka loan sharks are back, and thriving in the UK again. An investigation by Fair4All Finance suggested that borrowers are now taking out loans of about £3,000 on average, and that the current clients were even more likely to be lower-waged, full-time workers. While the recent cost of living rise is prompting single mums and benefit families into looking to borrow smaller amounts of between £500 and £1,000, simply to pay gas and electricity bills, or even for groceries ..... most of the loan sharks clients were even more likely than the average person, to have been refused credit elsewhere because of poor credit ratings, before turning to an illegal moneylender.

Illegal loans that can have interest rates of up to 50%, or even be on "double bubble" terms (where the original loan is doubled each month), are not uncommon ... non repayment often leads to threats of violence, property vandalism, and ultimately violence against the lender or their families.

So how many illegal loan sharks are operating in the UK? Well, its hard to estimate accurately, but a think tank, the Centre for Social Justice guesstimated that about one million people in England could currently owe money to illegal moneylenders. While the Illegal Money Lending Team, which prosecutes loan sharks in England, said that about a fifth of the loan sharks they prosecute are women.

So what's the alternative to loan sharks, if you need cash and can't get a legal loan? Well, their are community lenders or credit unions (these are usually self-help co-operatives, whose members pool their savings to provide each other with credit at a low interest rate), are used by about 1.98 million people across the UK according to the Bank of England ... but as I understand it, credit unions usually only operate in certain geographical or economic areas, and members usually share a common bond with other members.

These common bonds may be such as:

- Living or working in the same area.

- Working for the same employer.

- Belonging to the same church, trade union or other association.

..... but, lets be honest, in our increasingly broken UK society, many of those needing these loans and then approaching loan sharks, are not in any church, are unlikely to be working for a common employer or in the same industry industry, and not likely to be known by many neighbours. So these credit unions are not really of much help to many people, when a final demand arrives, or the food has run out.

I have blogged a few times on personal debt before, and how fragile the finances of up to a third of the UK (and up to 40% of US) citizens are. That's a large minority of UK and US citizens who are living in a more or less continual state of financial jeopardy. In the UK 18% of working adults/families would be unable to pay the rent or mortgage, even for the first month, if they lost their job and were unable to find another one immediately.

While in the US, in 2016 the public were asked the question. "How would you pay for a $400 emergency?" The answer: 47% of the respondents said that either they would have to cover the expense by borrowing, or by selling something, or they would not be able to come up with the $400 at all.

With those kinds of facts, its obvious that the loan shark will never be short of customers.

No comments:

Post a Comment

All comments are welcomed, or even just thanks if you enjoyed the post. But please make any comment relevant to the post it appears under. Off topic comments will be blocked or removed.

Moderation is on for older posts to stop spamming and comments that are off topic or inappropriate from being posted .... comments are reviewed within 48 hours. I don't block normal comments that are on topic and not inappropriate. Vexatious comments that may cause upset to other commentators, or that are attempting to espouse a particular wider political view, are reviewed before acceptance. But a certain amount of debate around a post topic is accepted, as long as it remains generally on topic and is not an attempt to become sounding board for some other cause.

Final decision on all comments is held by the blog author and is final.

Comments are always monitored for bad or abusive language, and or illegal statements i.e. overtly racist or sexist content. Spam is not tolerated and is removed.

Commentaires ne sont surveillés que pour le mauvais ou abusif langue ou déclarations illégales ie contenu ouvertement raciste ou sexiste. Spam ne est pas toléré et est éliminé.