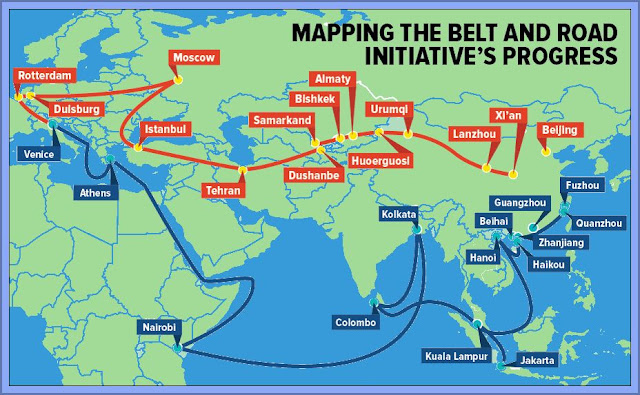

The Chinese One Belt, One Road policy ....

|

| The Belt And Road Initiative Is Often Followed By Debts |

.... is the way in which China has been exporting influence around much of the globe by building road, rail and sea links to boost trade with the countries who take these loans.

Critics say that the "Belt and Road Initiative” (BRI) is simply enabling “debt book diplomacy” by China, allowing them to exert pressure on nations to support Chinese geo-political aspirations e.g. In the South China seas.

With many western analysts believing that these countries may have walked into a Chinese "debt trap". Beijing has loaned billions of dollars to many countries as part of its BRI to build infrastructure in Asia and Africa, even though many of the countries were already laden with debt and not officially able to take on more.

However, much of this additional funding has not necessarily worked in those countries favour, and left assets in Chinese hands, although technically asset seizure in lieu of repayment was only allowed in the case of direct government loans, while the semi private loans are supposed to be funded by repayments taken from the revenue generated by the projects. However China often secures debts by collaterisation, with 40 of the 50 largest loans being collateralised, often against future raw commodity exports.

For example Sri Lanka, in 2017, China Merchants Port Holdings took a majority share with a 99-year lease in the strategically important Hambantota port, after Sri Lanka struggled to repay the debt incurred to build it ... they had borrowed more than $1bn (£770m) to build it, but according to some reports its barely used, and so Sri Lanka has to consider selling land around the port to yet more Chinese developers, to build a business zone to try and attract ships to the port.

This fate is also the likely outcome of the Colombo Port City project, which is another project in Sri Lanka that is also being funded by $1.4billion dollars in Chinese investment. Similarly Mattala Rajapaksa international airport, built barely 30km from Hambantota, which has just five flights a week, serving just a few hundred passengers.

In fact Sri Lanka has been like a drunk in a pub, and built a lot of white elephants, all financed by loans (mostly from Chinese sources) ... for example a state-of-the-art conference centre that is barely used, and a cricket stadium that is now only occasionally rented out for weddings. There is even a brand new city being built off the coast of Colombo, on a spit of reclaimed land that the developers, the China Harbour Engineering Company, claim will become a new financial hub for South Asia.

The only positives of the Chinese loans in Sri Lanka so far are the roads and motorways, that were laid all over the country, and which at least helped boost tourism before Covid-19 (ironically, another Chinese export 😉), halted it, and which was the country's biggest source of foreign income. In all Sri Lanka owes at least $8bn to Chinese companies or its government and in fact such is Sri Lanka's dependence upon foreign loans that the island's total debt to the world stands at about $64bn and about 95% of all government revenues go towards debt repayment ... unsustainable.

They have now offered to pay their $251m debt to Iran by sending $5m (£3.8m) worth of tea to Iran each month to clear the loans (Iran's response is not known). They have also asked China to restructure their debt repayments, to help the country manage its desperate financial situation.

But in April 2022, unable to secure debt repayments in kind, Sri Lanka said it would temporarily default on its foreign debts, blaming the impact of the pandemic and the Ukraine war, that made it "impossible" to pay its creditors. Its in its worst economic crisis in over 70 years and suffering food shortages, soaring prices and power cuts, there have been mass protests. Officials noted that an "unblemished record" of paying its dues since independence from the UK in 1948 but that "Recent events, however... have eroded Sri Lanka's fiscal position that continued normal servicing of external public debt obligations has become impossible."

The violent reaction to the current economic chaos in Sri Lanka has caused Prime Minister Mahinda Rajapaksa to quit. with the new PM describing the Sri Lankan economy as "broken," with food, medicine and fuel running out or becoming unaffordable. Some people have reportedly died while waiting at petrol stations to fill up cars, and people not being able to afford to eat, even if food is available.

But Sri Lanka is not the only country to be in a mess. For instance Nepal - for different reasons - has restricted imports of non-essential goods - including cars, cosmetics and gold - after its foreign currency reserves dropped. This after a pandemic driven fall in tourism spending and money sent home by Nepalis working abroad helped drive up government debt.

However many of these government borrowing debts are because, unlike individuals, international lenders do not do always perform the full credit checks before giving states loans. According to the Harvard Business Review in total, the Chinese state and its subsidiaries have lent about $1.5 trillion in direct loans and trade credits to more than 150 countries around the globe. This makes China the world’s largest official creditor — surpassing traditional, official lenders such as the World Bank, the IMF, or all OECD creditor governments combined.

A recent report by AidData says that China is owed $385bn – including 'hidden debt' from poorer nations. The researchers identified debts of at least $385bn (£286bn) owed by 165 countries to China for its “Belt and road initiative” (BRI) projects, with many of the loans being systematically under-reported to international bodies such as the World Bank. The report said that the debts are “substantially larger than research institutions, credit rating agencies, or intergovernmental organisations with surveillance responsibilities previously understood”.

In all 42 low-to-middle income countries (LMICs) had a debt exposure to China that exceeded 10% of their GDP, these included countries such as Laos, Papua New Guinea, the Maldives, Brunei, Cambodia and Myanmar. A dozen of these countries owe debt of at least 20% of their nominal GDP to China - Djibouti, Tonga, Maldives, the Republic of the Congo, Kyrgyzstan, Cambodia, Niger, Laos, Zambia, Samoa, Vanuatu, and Mongolia.

This debt is largely not comprised of state to state loans, as since the BRI initiative was launched, almost 70% of loans are between Chinese state-owned companies and banks, joint ventures, private institutions, or special purpose vehicles (SPVs), and the debtor governments. A factor which effectively hides the debts from international scrutiny by the World Bank, the IMF, or credit-rating agencies, even though they all normally carry explicit or implicit forms of host government liability protection which guarantee repayment.

Collaterised Chinese loans are mortgaging countries natural resources or revenues e.g. Russia secured loans and export credits worth $125bn, mostly contracted by Russian state-owned oil and gas enterprises by collateralising it with the proceeds from oil and gas sales to China. Similarly Venezuela secured $86bn in non-concessional and semi-concessional debt from China’s state-owned policy and commercial banks, mostly through loans collateralised against its future oil exports.

China also disproportionately lends to countries that performed poorly on conventional measures of credit worthiness, but demans far higher interest rates with shorter repayment periods. For example Pakistan has Chinese loans with average interest rates of 3.76%, compared with a typical OECD-linked loan’s rate of 1.1% and despite the fact that a lot of international banks wouldn’t even lend to Pakistan.

In fact so pernicious has Chinese debt collection and overseas lending activities been that when adding in its portfolio debts (including the $1 trillion of U.S. Treasury debt purchased by China’s central bank) and trade credits (to buy goods and services), then the Chinese government’s aggregate claims to the rest of the world exceed $5 trillion in total. In other words, countries worldwide owed more than 6 per cent of world GDP in debt to China as of 2017, and that will have gone up in the last five years, although there are reportedly indications that credit outflows from China have slowed markedly since 2015 as China tries to grow its middle classes to create a home market.

Now on the right projects and for the right price, Chinese money and Chinese developers can create infrastructure that works for the hosts and the investors. But that is not always the case by any means, and many of the projects being financed are unsustainable or vanity white elephant projects, and its highly possible that the initiative could just fuel corruption, and leave a swathe of rusting infrastructure and debt mountains across south Asia and the globe.

Over an 18-year period, China has granted or loaned money to 13,427 infrastructure projects worth $843bn across 165 countries in the form of risky high-interest loans from Chinese state banks.

Some countries are in such debt to the Chinese that their credit rating has been downgraded to "junk" status, meaning that they can't get credit anywhere else. A prime example is Laos, who were suckered in to a bad deal that makes them responsible for any debts on a $5.9bn railway that the Chinese built, that largely benefits the Chinese.

The deal was so bad that in September 2020, with the country on the brink of bankruptcy, it sold a major asset to China, handing over part of its energy grid for $600m in order to seek debt relief from Chinese creditors. Djibouti, Laos, Zambia and Kyrgyzstan all have debts to China equivalent to at least 20% of their annual GDP and there are now more than 40 low and middle-income countries, according to AidData, whose debt exposure to Chinese lenders is more than 10% of the size of their annual economic output (GDP) as a result of this "hidden debt".

Belatedly the G7 leaders have detailed plans to mobilise $600bn in funding for the developing world in a move seen as a counter to China's Belt and Road plan. However, the plan might simply be too little and have come along way too late to counter the Chinese power grab.

Update:

October 2023: Sri Lanka has confirmed that it has reached a deal with China, to restructure $4.2bn (£3.4bn) of debt after Sri Lanka defaulted on its foreign debt in May 2022. Sri Lanka's Finance Ministry said in a statement: "We thank China Exim bank (Export and Import bank) for the support in resolving our country's debt situation. This agreement constitutes a key milestone in Sri Lanka's ongoing efforts to foster its economic recovery."

October 2023: More than 145 countries have signed up to the October 2023 Belt and Road Initiative (BRI) summit in Beijing, accounting for three-quarters of the world's population and half of the globe's total wealth .... Chinese bribes and actually building of the projects quickly, apparently outweigh the ecological damage, the local population displacement and sociological impacts, the use of imported Chinese workers rather than (lazy) local workers, and the debt.

The West has lost the battle it seems .....

No comments:

Post a Comment

All comments are welcomed, or even just thanks if you enjoyed the post. But please make any comment relevant to the post it appears under. Off topic comments will be blocked or removed.

Moderation is on for older posts to stop spamming and comments that are off topic or inappropriate from being posted .... comments are reviewed within 48 hours. I don't block normal comments that are on topic and not inappropriate. Vexatious comments that may cause upset to other commentators, or that are attempting to espouse a particular wider political view, are reviewed before acceptance. But a certain amount of debate around a post topic is accepted, as long as it remains generally on topic and is not an attempt to become sounding board for some other cause.

Final decision on all comments is held by the blog author and is final.

Comments are always monitored for bad or abusive language, and or illegal statements i.e. overtly racist or sexist content. Spam is not tolerated and is removed.

Commentaires ne sont surveillés que pour le mauvais ou abusif langue ou déclarations illégales ie contenu ouvertement raciste ou sexiste. Spam ne est pas toléré et est éliminé.